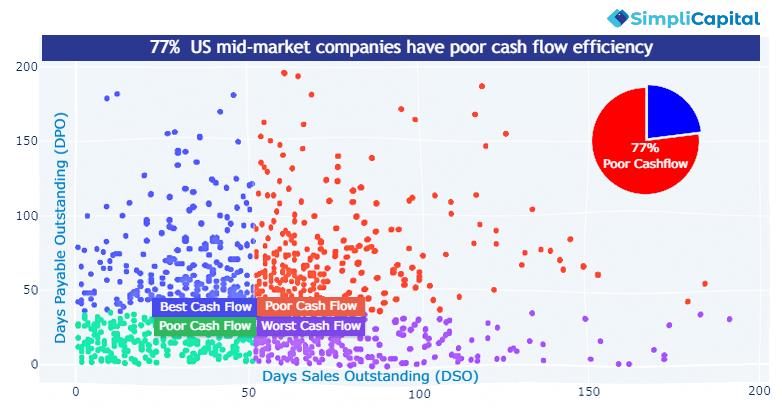

Most companies fail due to poor cash flow! We analyzed 1,200 companies. To our surprise, only 1 in 4 companies manage their cash efficiently and there were no significant differences by sector or by company size. So what makes them good?

The best-in-class companies stand above their peers in two critical metrics

- Days Sales Outstanding (DSO), how fast their customers pay them

- Days Payable Outstanding (DPO), how fast do they pay their suppliers

CFOs of these companies minimize DSO and maximize DPO to an extent that their receivables are enough to cover payments to their suppliers and others.

An efficient cash flow minimizes the need for drawing bank lines, reduces the cost of capital and adds a significant bump to the bottom line.

On the contrary, most CFOs only dream of such an efficient cash flow. Based on our study of over 150 companies, their finance departments are typically thinly staffed. Most CFOs are barely able to track cash flow data on a weekly or monthly basis and most of their work is done manually.

The best CFOs manage cash real-time, anticipate friction, and proactively solve for a fast and predictable cash flow!

Contact SimpliCapital (info@simplicapital.ai) to learn more.

#cashflow #cashforecasting #accountsRecievable #accountspayable #ai #artificialintelligence #finance #workingcapital