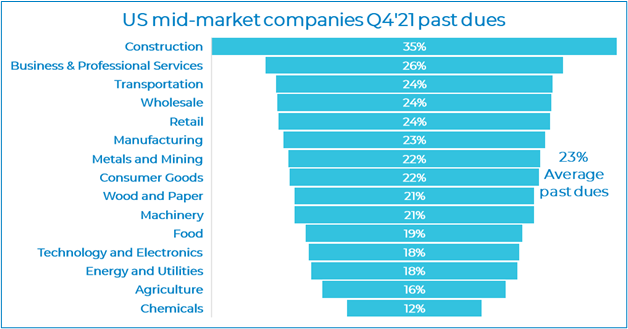

Are you surprised that on an average, 23% of the trade receivables of US mid-market companies were past due in Q4’21?In fact, companies in a few sub-sectors had as much as 67% of their receivables past due. Moreover, the past dues percent increased by over 1 percent versus Q3’21.

Typically, companies have to maintain a cash buffer to pay their suppliers, employees and other payables. If on the other hand, their customers are paying their invoices late, that’s akin to interest-free credit! This further increases the need for a larger cash buffer which in turn increases the borrowing costs and dilutes a company’s profit margins.

Why do customers not pay on-time? There are six key reasons:

- Very often, a customer simply forgets and needs to be sent a reminder before their due date

- Finance teams are typically short-staffed and therefore unable to chase every invoice

- Predicting payment patterns is complex so finance teams focus on either the biggest invoices and/or the most delinquent ones

- For some customers, payment due dates may not align with their A/P cycles, causing systematic late payments

- Customers often hold back payments due to delays, invoicing errors or pricing disputes

- Finance teams are afraid of customer abrasion and therefore call their customers only when they are significantly past due

Past dues are the biggest source of uncertainty in cash flows. This uncertainty amplifies in significance when the cash position is tight. During a recessionary cycle, it can result in a disaster for an otherwise healthy company.

CFOs can significantly reduce past dues by proactively tackling potential late payments. They must look beyond simple spreadsheet-based techniques to improve their receivables inflow and consequently, cash flow health.

Innovative CFOs are utilizing powerful artificial intelligence techniques to improve predictability and speed of cash flow. The challenge today for them is to find solutions that are powerful, yet easy to implement and do not require a massive investment in let’s say, a data science department.

Contact SimpliCapital (info@simplicapital.ai) to learn more.